How to make a bulk payment

Introduction

TransferClear’s Bulk Payment functionality provides the capability to make payments in bulk through TransferClear. This happens via a file (.csv) upload containing payments details and reciever information through the client profile interface.

Please see below for further information and if you have any questions, please contact us at s.ch@transferclear.com.sg or speak to your Relationship Manager.

Requirement to file format for bulk upload

The file format that is used for the bulk upload of internal payments (client to client) is .CSV. In presented below table, you can find the values that must be provided through in the uploaded CSV file, with the corresponding header text.

Download CSV example – full file (29 columns)

Download CSV example – payment to a beneficiary with external reference (8 columns)

Download CSV example - full file with originators (38 columns)

ATTENTION, the batch file must:

1. Have the headers necessary to successfully process a file. The headers should have the exact same spelling as those provided in the table whith file format. If the headers provided do not exactly match the expected ones, a validation error will occur, and it will not be possible to process the file any further.

2. Do not have other columns with different names from those in the sample.

3. Do not have more columns from those in the sample or rearrangements of the columns.

4. Eligible symbols for input are all uppercase and lowercase Latin letters, numbers and symbols.

Note: If Microsoft Excel is used for the file creation/editing, please ensure that all the fields are formatted as “Text” in order to avoid any auto-formatting of numbers that could result in a validation failure

The process of creating a Bulk wire transfer

To create a mass payment in a profile, you should perform the following steps:

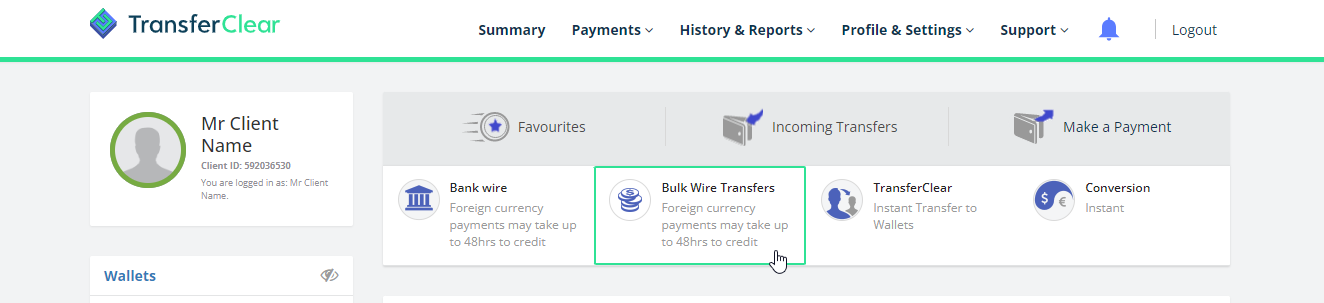

Bulk upload main screen

Log into the personal profile. On the main page, select “Bulk wire transfer” from the proposed options for outgoing payments.

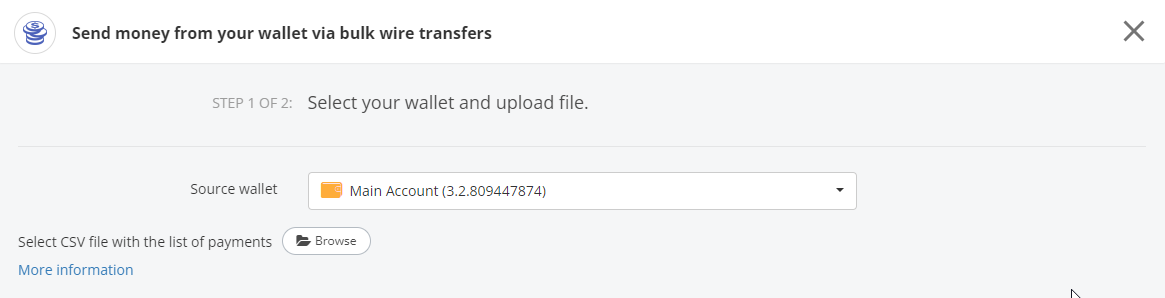

Selecting a file to upload

The first screen for creating a Bulk wire transfer will open. You need to select a source account and add a CSV file that meets the requirements, clicked on the "Browse" button.

After that, the file is loaded into the system.

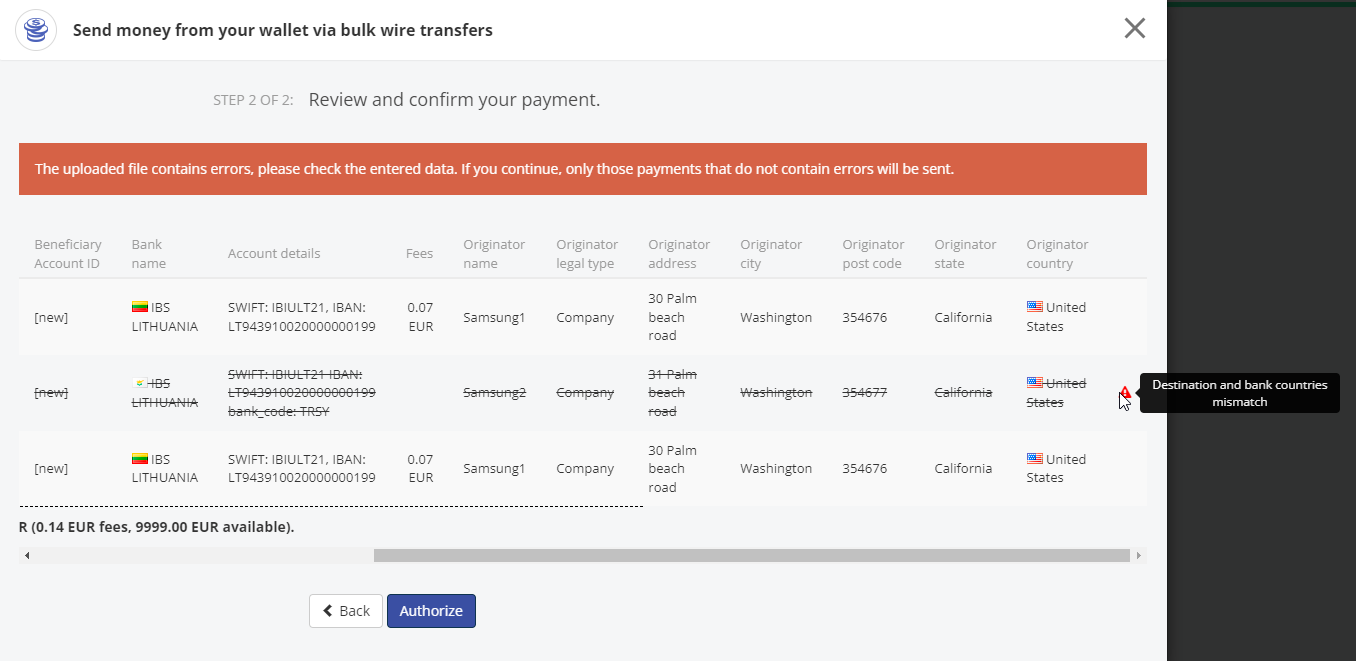

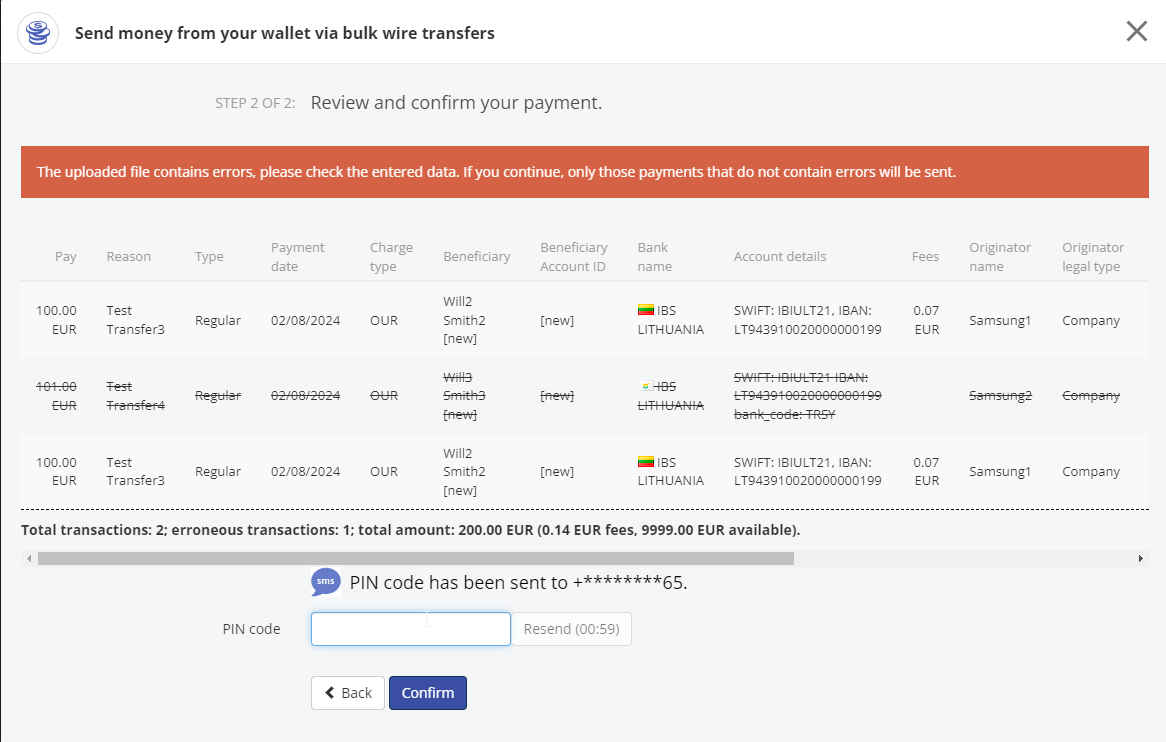

File validation

The system will check the possibility of making all transactions from the list (the receiver of the transaction is found in the system, there is enough balance on the account, etc). At this stage, the user is also able to see an overview of the file contents on the screen. If there are any validation errors or warnings, the user can see a corresponding message text. Based on this information the user should update the file and upload it again for validation. If no errors are found, the user can proceed further with the processing of the file by clicking on the “Authorize” button.

File processing

User should click the “Authorize” and enter the 2-factor authorization code to execute the transaction list.

To complete the creation of transactions after entering the 2FA confirmation code, the client presses the “Confirm” button.

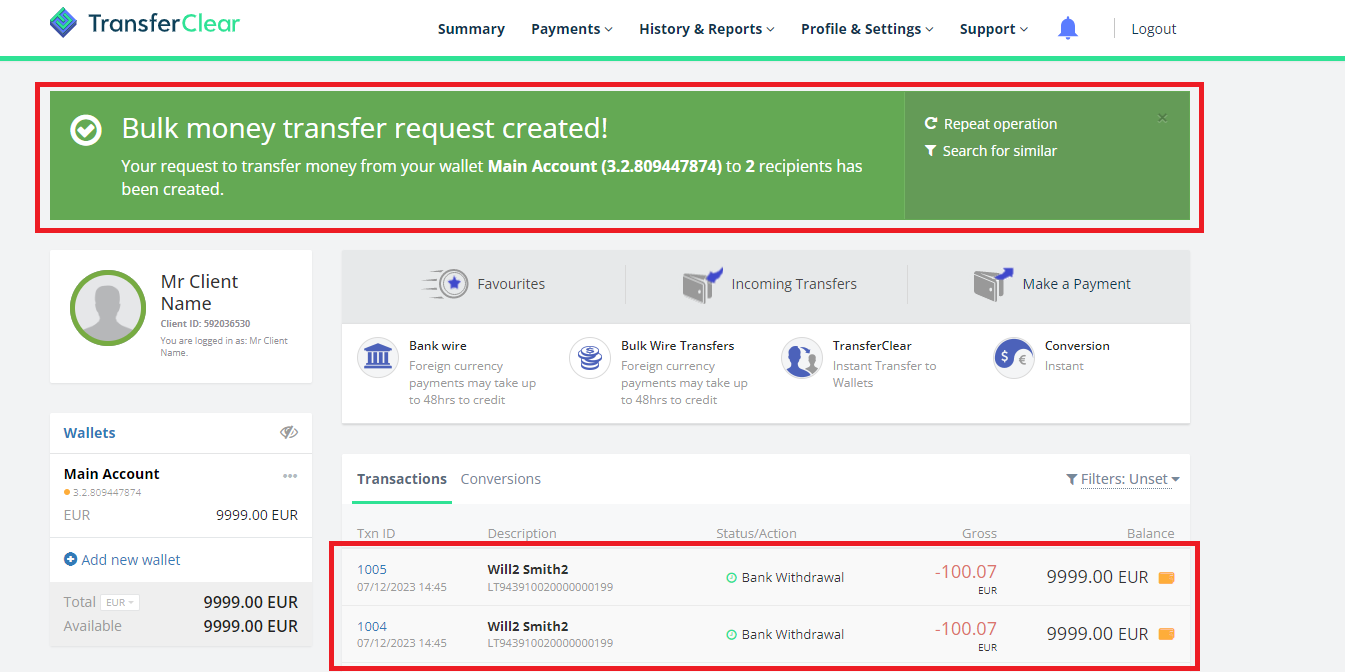

Completing bulk payment

When the bulk transactions are created and authorized, the system shows the corresponding notification to the client and the created transaction list will be stored in transaction history.

File format for bulk payments

| Header | Description | Conditions |

|

If you know the exact amount you want the beneficiary to receive, please provide a value in this field |

Number that can contain two decimal places |

|

The currency you want the beneficiary to receive. |

3 character code from the International currency code standard ISO 4217 |

|

The reason for the payment |

Can be up to 140 alphanumeric characters long. Mandatory for payments and conversions |

|

The date you want the payment to be processed and sent to the beneficiary |

Date field in the ISO 8601 format (YYYY-MM-DD). In addition to ISO 8601, the following date formats have been added: "yyyy.MM.dd", "yyyy/MM/dd", "dd.MM.yyyy", "dd-MM-yyyy", "dd/MM/yyyy". Mandatory for payments and conversions |

|

You can make a “priority” payment which is fast and more expensive, or a “regular” payment which can be slower but is cheaper. The value of this field should be either “priority” or “regular”. |

Field with options of “priority” or “regular”. Mandatory for payments. |

|

When payment_type=’priority’, depending on the account setup, there is the option to select if the payment should have charges ‘OUR’ or ‘SHA’ (shared). In the case of ‘OUR’ the payment cost is higher but the payment amount will arrive on the beneficiary account in full. In the case of ‘SHA’ (shared), payment costs are lower however any charges are deducted from the payment amount, so the payment may not arrive in full at the beneficiary account. |

Field with options of “SHA” (shared) or “OUR”. Optional for priority payments. |

|

A beneficiary reference that is known to the user, e.g. the beneficiary id used in the users external system/platform |

String – Required if a payment is made to an existing beneficiary OR if the user wants to update an existing beneficiary record. |

|

The country of the bank account you are making the payment to |

2 character code from the International country code standard |

|

Identifies the type of beneficiary, which will drive the type of name below |

One of either “company” or “individual” |

|

The exact name of the beneficiary on the bank account you are paying to. Warning – if this differs to the name the bank has on record, they may reject the payment |

Mandatory for payments. |

|

The legal name of the company |

mandatory if beneficiary_type is “company” |

|

The legal first name of the individual |

mandatory if beneficiary_type is “individual |

|

The legal last name of the individual |

mandatory if beneficiary_type is “individual” |

|

First line of address including building number or name |

This should be the legally registered address of the company or primary residence of the individual who is receiving the payment |

|

The city or town from the beneficiary’s address |

|

|

The state or province from the beneficiaries address |

String – mandatory for some countries (US, MX or CA) |

|

The postal code or zip code from the beneficiary’s address |

String – mandatory |

|

The country code from the beneficiaries address |

2 char ISO 3166-1 alpha-2 country code |

|

A bank identifier used worldwide |

8 or 11 characters and mandatory for most standard payments |

|

The account_number of the beneficiaries’ bank accoun |

Conditional field |

|

The international bank account_number, mainly used in Europe |

Up to 32 alphanumeric characters |

|

The American Bankers Association number, only used in the USA |

9 digit number which is mandatory for regular payments to the USA |

|

A bank identifier code used for regular payments |

4 digit number which is mandatory for regular payments to Singapore, Denmark and Sweden |

|

The Canadian Payments Association financial institution number, only used in Canada |

Unique three-digit code assigned to a certain bank or financial institution to identify them in Canada |

|

A bank identifier code used for regular payments |

3 digit number which is mandatory for regular payments to Singapore |

|

A bank identifier code used for regular payments |

6 digit number which is mandatory for local payments to the United Kingdom |

|

Identifies the type of bank account |

Required only for regular payments in USD to USA – one of either “checking” or “savings |

|

Bank account holder first name |

|

|

Bank account holder last name |

|

|

Bank account holder company name |

|

|

The name of the bank receiving the funds |

Mandatory. Check bank name received from bic_swift and from file |

|

Originator type is “company” or “individual” |

Mandatory for using originators |

|

Originator company name |

Mandatory for using originators if originator_type is company |

|

Originator first name |

Mandatory for using originators if originator_type is individual |

|

Originator last name |

Mandatory for using originators if originator_type is individual |

|

Originator address |

Mandatory for using originators |

|

Originator city |

Mandatory for using originators |

|

Originator postcode |

Mandatory for using originators |

|

State or province of address |

Mandatory for using originators |

|

2 character code from the International country code standard |

Mandatory for using originators |